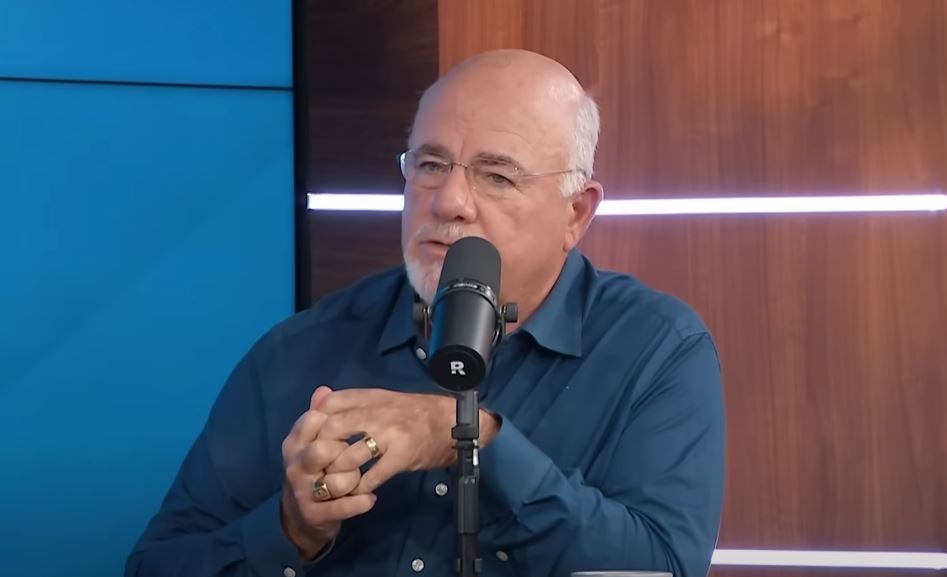

In addition to being incredibly inspirational, Dave Ramsey’s story of rising from financial ruin to establishing a $200 million empire exemplifies a philosophy that still influences millions of American homes. He had amassed a substantial real estate portfolio at the age of 26, but by the age of 28, he had lost it all. What came next was a dramatic change in direction, motivated by faith and experience, which solidified his identity as a financial leader and reshaped his career path.

By fusing biblical financial principles with hard-won lessons, Ramsey started developing a philosophy that struck a deep chord with regular families. The change was incredibly successful in addition to being strategic. By encouraging people to pay off the smallest balances first, his debt-reduction strategy—famously dubbed the “debt snowball”—creates immediate victories that boost motivation. Despite not being the best mathematical solution, this approach has been shown to be psychologically effective and has assisted in the escape of debilitating debt cycles for countless people.

Easy to Copy to WordPress

| Name | Dave Ramsey |

|---|---|

| Full Name | David Lawrence Ramsey III |

| Date of Birth | September 3, 1960 |

| Age | 64 |

| Occupation | Financial Author, Advisor, Radio Host |

| Company | Ramsey Solutions |

| Estimated Net Worth | $200 Million (2025) |

| Best-Selling Book | The Total Money Makeover |

| Marital Status | Married to Sharon Ramsey |

| Children | Denise, Rachel, Daniel |

| Primary Residence | College Grove, Tennessee |

The Ramsey brand has developed into a very effective machine over the last 20 years. With more than 20 million listeners each week, his daily radio show doubles as a financial boot camp and a public therapy session. Ramsey’s tone is very clear—firm but not rude—regardless of whether the call is about emotional spending or student loans. One of the most often mentioned factors contributing to his followers’ trust in him is his clarity.

His real estate strategy is one particularly creative choice that continues to influence his net worth. Ramsey won’t take out a loan, not even for large investments. He avoids the financial strain that frequently comes with leveraged assets and rising interest rates by opting to pay cash for properties. His $10 million Tennessee home, which he bought and then sold debt-free, is a real-world example of that idea. Ramsey’s strategy offers peace of mind, which is more difficult to measure, despite detractors’ claims that using leverage can boost returns.

Ramsey Solutions has strategically grown to offer podcasts, live events, courses, and a full staff of financial coaches. Sales of books, streaming media, financial tools, and endorsements are how the business makes money. The business is incredibly dependable during economic downturns thanks to its diverse structure and debt-free construction, something that most financial influencers cannot say.

Ramsey’s brand has been markedly enhanced by consistency and message alignment, avoiding the frequent pivots typical of social media-driven entrepreneurship. Ramsey’s advice is still based on tried-and-true principles like budgeting, saving, and living within one’s means, even as younger influencers scramble to capitalize on TikTok or cryptocurrency trends. In addition to fostering trust, this ageless appeal has increased his influence over several generations.

But Dave Ramsey’s detractors are not quiet. His claim of steady 12% returns on mutual funds is contested by some financial advisors, who point out that even the S&P 500 seldom produces such long-term results. Others think his one-size-fits-all advice is too general, especially for those with medical debt or low-income households. However, his supporters frequently refer to his advice as a lifeline—a stable point in the midst of economic turmoil.

Parts of his empire have been clouded by controversy in recent years. His contentious remarks during the COVID-19 pandemic, claims of workplace discrimination, and legal actions involving outside vendors like Timeshare Exit Team have all made headlines. His impact has hardly changed in spite of this. His unapologetic approach is well-liked by many fans, particularly in a time when strong opinions are more likely to be heard. Even though his company has a very traditional culture, it appeals to people who want moral clarity in business and finance.

Additionally, Ramsey’s family has assumed leadership positions. His three children, including Rachel Cruze, have become accomplished authors and public speakers. She creates her own content under the Ramsey Solutions banner and frequently performs live. Similar to how Warren Buffett has prepared his successors, Ramsey seems to be fostering a legacy through family, which is a remarkably resilient framework for ongoing influence.

Ramsey’s openness about his past mistakes is what makes his story so relatable. He doesn’t preach from a pedestal because he has been through bankruptcy himself. Rather, he speaks from a place of restoration, having gradually rebuilt his financial life after losing everything. Because of his relatability, callers frequently cry on-air as they express gratitude for improving not only their financial situation but also their marriages, confidence, and mental health.

Ramsey’s brand has lasted remarkably well by fusing classic principles with modern messaging. He sells hope in addition to financial instruments. That hope becomes particularly valuable in an economic environment that is frequently characterized by uncertainty and inflation anxiety. Even though his net worth is estimated at $200 million, it could easily be higher when real estate assets and private equity in Ramsey Solutions are taken into consideration. According to some estimates, it might be close to half a billion dollars.

Ramsey’s success provides a particularly helpful model for middle-class families. Steer clear of debt. Don’t overspend. Donate liberally and save. For millions, these straightforward guidelines—which are frequently reiterated—have brought financial clarity. Additionally, they have made it possible for Ramsey to rise to prominence in American finance without resorting to ostentatious advertising or viral tricks.